At The People’s Reserve LLC, we see the weaknesses of traditional cryptocurrency.

We also look beyond that to recognise the tremendous potential of blockchain technology.

We saw the possibility to utilise blockchain technology to build a superior form of digital currency.

An innovative form of digital currency that is not only super-fast and low cost – but has the ability to bring power back to the people.

At The Peoples Reserve LLC we see the weakness of traditional cryptocurrency.

We also see past that to recognise the tremendous potential of blockchain technology.

We saw the possibility to utilise blockchain technology to build a superior form of digital currency.

An innovative form of digital currency that wasn’t only super-fast and low cost – it could bring power back to the people.

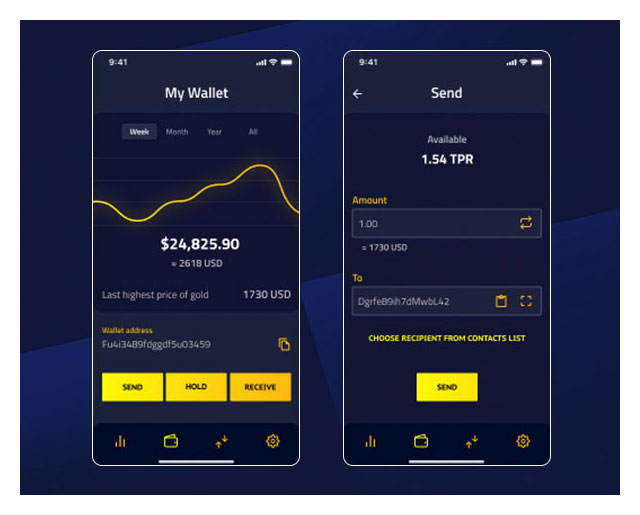

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

WE HAVE CONSENSUS – Consensus explained…

– Our current money (fiat currency)

has nothing backing its value.

In essence – The reason it has value is because we agree it has value.

To explain…

If you receive a $50 note and also receive a $100 note.

Why is one note worth 2X the other?

There isn’t double the value backing it, so how does it actually have double the value?

It’s simply because we agree.

This is the power of consensus – and we hold this power.

With respect to CONSENSUS & TPR…

***There are hundreds of Businesses who accepting TPR as a currency to buy quality goods

and services. We believe this agreement is the ultimate form of consensus…

Actual transactions for goods – Using The TPR Digital Currency.

***The list of businesses accepting TPR for payment continues to grow, destined to be a

global list of thousands.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

To The Last Highest Price of Gold on The Exchange.

– How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

WE HAVE CONSENSUS – Consensus explained…

– Our current money (fiat currency)

has nothing backing its value.

In essence – The reason it has value is because we agree it has value.

To explain……

If you receive a $50 note and also receive a $100 note.

Why is one note worth 2X the other?

There isn’t double the value backing it, so how does it actually have double the value?

It’s simply because we agree.

This is the power of consensus – and we hold this power.

With respect to CONSENSUS & TPR…

***There are hundreds of Businesses who accepting TPR as a currency to buy quality goods and services. We believe this agreement is the ultimate form of consensus…

Actual transactions for goods – Using The TPR Digital Currency.

***The list of businesses accepting TPR for payment continues to grow, destined to be a global list of thousands.

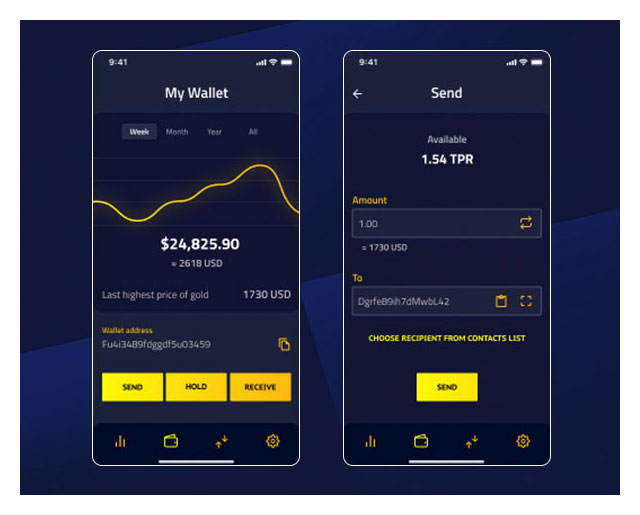

The People’s Reserve Offers…

– Compounding Rewards at 12- 16% – (in the TPR Wallet)

– Compounding Rewards are offered to TPR Wallet holders for agreeing to participate in the network.

– Compounding Rewards are offered to TPR Wallet holders for agreeing to participate in the network.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

The People’s Reserve Offers…

Compounding Rewards at 12- 16% – (in the TPR Wallet)

Compounding Rewards are offered to TPR Wallet holders for

agreeing to participate in the network.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

DEBT-FREE

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

DEBT-FREE

Two Innovation PATENTS

– All Issued

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

Extensive, Third Party…

Independent Blockchain Audit…

– Verifying the blockchain speed and other attributes.

Two Innovation PATENTS

– All Issued

Extensive, Third Party, Independent Blockchain Audit…

– Verifying the blockchain speed and other attributes.

Fiat-Backed Reserve Pool…

Fiat reserves are automatically withdrawn from TPR coin sales done by TPR on the TPR exchange (once the TPR exchange is operational).

This is to add fiat reserves, should they be needed, to support the value of the TPR digital currency.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

Fiat-Backed Reserve Pool……

Fiat reserves are automatically withdrawn from TPR coin sales done by TPR on the TPR exchange (once the TPR exchange is operational).

This is to add fiat reserves, should they be needed, to support the value of the TPR digital currency.

Speed of transaction – usually within 4 – 10 seconds.

Up to 25 FREE TRANSACTIONS Per day.

A Complete Digital Currency Eco-System – Including..

– Native Coin + Wallet + Exchange + Crypto Reporting Platform

The Peoples Reserve Digital Currency is a Native Coin..

Built on it’s own blockchain – Very powerful and not common

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

Speed of transaction- usually- within 4 – 10 seconds.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

Up to 25 FREE TRANSACTIONS Per day.

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

A Complete Digital Currency

Eco-System – Including..

– Native Coin + Wallet + Exchange + Crypto Reporting Platform

Value of the TPR is – ANCHORED–

To The Last Highest Price of Gold on The Exchange.

How does this work? The short answer is….

An innovative algorithm attempts to influence supply and demand to benefit TPR.

The Peoples Reserve Digital Currency

is a Native Coin..

Built on it’s own blockchain – Very powerful and not common